Guide to Qualifying New Suppliers in Malaysia for Manufacturing Success

Malaysia is a premier manufacturing hub in Southeast Asia. According to the Malaysian Investment Development Authority (MIDA), “Malaysia, with its extensive trade....

By AMREP | Posted on May 26, 2025

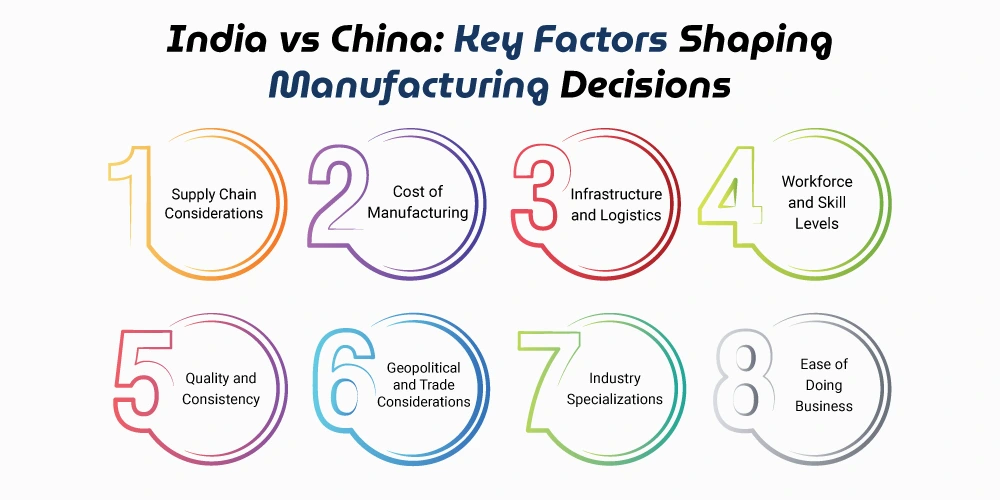

Global manufacturing is continuously evolving at a remarkable pace. Geopolitical shifts, digital transformation, cost pressures, and supply chain realignments are prompting businesses worldwide to revisit long-standing sourcing strategies.

For decades, China has reigned as the "world’s factory," with unmatched infrastructure and supply chain integration. However, India is rapidly emerging as a competitive alternative, supported by economic reforms, a growing workforce, and favorable global positioning.

As companies seek more resilient, cost-effective, and diversified manufacturing bases, the India vs. China debate has become more relevant than ever. So, which country is the right choice for your business in 2025? Let’s take a deep dive.

As global supply chains evolve, understanding the strengths and limitations of India and China is essential for making informed, strategic manufacturing choices.

Both countries present distinct supply chain environments shaped by infrastructure, ecosystem maturity, and logistical performance.

China has a highly integrated and mature supply chain network that supports nearly every manufacturing vertical from electronics and automotive to consumer goods and industrial machinery. According to the World Bank’s Logistics Performance Index (LPI) 2023, China ranked 19th globally, excelling in areas like infrastructure, customs clearance, and shipment reliability. Its well-established clusters, such as those in Shenzhen, Guangzhou, and Suzhou, offer proximity to component suppliers, skilled labor, and export hubs, which results in shorter lead times and reduced supply chain complexity.

Moreover, China’s reputation as the factory of the world is bolstered by its dominance in critical inputs such as rare earth elements, advanced semiconductors (particularly in collaboration with Taiwan), and lithium-ion battery components. For companies requiring tight timelines, large-scale production, and high output consistency, China’s supply chain remains difficult to match.

India, while historically lagging in supply chain maturity, is making rapid progress. The country ranked 38th in the World Bank LPI 2023, up from 44th in 2018, thanks to major infrastructure upgrades and logistics digitization through initiatives like the PM Gati Shakti National Master Plan. India is also investing in multimodal transport corridors, port modernization, and warehousing to enhance supply chain fluidity.

However, Indian supply chains still face challenges such as port congestion, inconsistent transport quality, and regional disparity in supplier capabilities. Lead times can be longer and supply chain coordination more complex, especially in rural or Tier 2 and Tier 3 manufacturing zones.

That said, India’s growing integration into global supply chains, particularly in sectors like electronics, automotive components, and pharmaceuticals, is creating more resilient and responsive networks. Many global companies are diversifying their sourcing strategies with an India plus one approach, balancing their China exposure while tapping into India’s improving logistics environment.

While China still offers economies of scale and production efficiency, labor costs have steadily increased due to a growing middle class and higher living standards. According to data from Statista, average manufacturing wages in urban China exceeded $9 per hour in 2024. Additionally, the cost of compliance with environmental regulations has risen significantly, increasing the total cost of ownership for manufacturers operating in China. India maintains a significant labor cost advantage, with average manufacturing wages remaining below $3 per hour in most regions. The Indian government’s “Make in India” and “Production Linked Incentive (PLI)” schemes are also providing tax breaks, subsidies, and infrastructure upgrades, particularly in electronics, textiles, and pharmaceuticals. As a result, India is more cost-effective for labor-intensive manufacturing, while China remains competitive for high-volume, automated, or high-precision production.

China’s world-class infrastructure includes over 40,000 km of high-speed rail, sophisticated port systems like those in Shanghai and Shenzhen, and efficient logistics hubs. Its integrated manufacturing clusters enable just-in-time production and rapid shipping.

India’s logistics network has made major strides through initiatives like the Bharatmala and Sagarmala programs, along with the rollout of GST. However, challenges persist in last-mile delivery, port congestion, and inter-state transport delays. While China maintains a clear lead in infrastructure, India is narrowing the gap, particularly in coastal industrial zones and major cities.

China has a highly skilled manufacturing workforce with strong experience in complex sectors such as automotive, semiconductors, and aerospace. Vocational training programs and automation adoption continue to enhance labor productivity.

India has the youngest workforce among major economies and produces over 1.5 million engineering graduates annually. However, practical skill gaps remain, particularly in mid-skill manufacturing and factory-level execution. That said, India excels in sectors that benefit from digital skills, such as IT-enabled manufacturing. China currently leads in advanced manufacturing expertise, but India shows strong potential in digitally integrated and labor-driven industries.

With decades of experience serving Fortune 500 companies, Chinese factories consistently meet international standards such as ISO 9001, IATF 16949, and RoHS. Strong quality control systems and automation reduce variation.

While Indian manufacturers are improving rapidly, particularly in automotive and pharma, quality consistency can still vary widely across suppliers. Quality assurance often requires stronger oversight and investment from buyers. China has the edge in delivering consistent quality, especially for complex products, while India is catching up but demands closer monitoring.

Tensions with the U.S., EU, and neighboring countries have led to tariffs, sanctions, and tighter export regulations. The COVID-19 pandemic and the push for supply chain diversification have accelerated the “China+1” strategy among global firms.

India enjoys stronger relations with Western countries and has signed multiple Free Trade Agreements (FTAs) with Australia, the UAE, and ASEAN nations. Its neutral geo-political stance is attracting foreign investors looking to hedge risks. This gives India an advantage as a more geopolitically stable environment for global manufacturers seeking diversification and risk mitigation.

| Sector | China | India |

|---|---|---|

| Electronics | Advanced, including semiconductors, EVs | Growing, focus on mobile phones & components |

| Automotive | EVs, parts, and full vehicle assembly | Auto components, 2-wheelers, low-cost cars |

| Aerospace | Mature and certified | Emerging |

| Pharmaceuticals | API and chemical manufacturing | Generics and formulations |

| Textiles | Synthetic and technical textiles | Cotton, garments, labor-intensive products |

China remains dominant in high-tech and automated sectors. India, on the other hand, offers advantages in cost-sensitive, labor-intensive, and pharmaceutical manufacturing.

China ranks highly for business efficiency, with industrial parks, export processing zones, and foreign investment policies well-structured. However, concerns around intellectual property (IP) protection, transparency, and government intervention persist.

India has improved its “Ease of Doing Business” ranking significantly, thanks to digitization, tax reforms, and simplification of business setup processes. Still, bureaucratic delays and state-level inconsistencies can hinder operations. China currently offers more predictability, but India is rapidly becoming more foreign-investor friendly.

Both China and India present significant opportunities for manufacturers, each with distinct advantages in market access and growth potential.

China remains a global manufacturing powerhouse with a vast domestic market. Its middle class, defined by the National Bureau of Statistics as households earning between RMB 100,000 to RMB 500,000 annually, has been a key driver of consumption. However, recent data indicates a cautious consumer outlook, with annual consumption growth expected to rise by only 2.3% in 2025, mirroring the 2.4% growth seen in 2024 . This stagnation is attributed to factors such as urbanization plateauing at 67% in 2024 and lingering effects of the pandemic on consumer confidence.

India, on the other hand, is experiencing a surge in consumer spending. Projections indicate that India's consumer market will expand from USD 2.4 trillion in 2024 to USD 4.3 trillion by 2030 . This growth is fueled by a young, urbanizing population and rising incomes. The Indian government has also been proactive in attracting foreign investment, with initiatives like the Production Linked Incentive (PLI) Scheme aimed at boosting domestic manufacturing.

While China's established infrastructure and mature supply chains offer reliability, India's expanding market and supportive policies present compelling opportunities for businesses looking to tap into new growth avenues.

There is no universal answer. The best manufacturing destination depends on your unique business needs:

Choose China if you:

Choose India if you:

Ultimately, your decision should be guided by a combination of product requirements, supply chain strategy, market access goals, and long-term risk management. An in-depth evaluation of both countries in the context of your business priorities will yield the best outcome.

At AMREP, we specialize in helping global businesses navigate complex sourcing decisions across Asia. As a leading supplier quality management company, AMREP provides:

Contact AMREP today to determine the best fit manufacturing strategy for your business in 2025 and ensure quality from the very first shipment.

Contact Us To See What We Can Do

Call Us

Mon - Sat 9.00 - 18.00

Sunday Closed

12 - May 2025

12

May

2025

Malaysia is a premier manufacturing hub in Southeast Asia. According to the Malaysian Investment Development Authority (MIDA), “Malaysia, with its extensive trade....

22 - April 2025

22

April

2025

Healthcare is rapidly evolving, ensuring consistent and high-quality patient care. Total Quality Management (TQM) in healthcare is more than just a buzzword—it is a powerful....

16 - April 2025

16

April

2025

Total Quality Management (TQM) is a mindset that involves everyone in the organization working toward a common goal: achieving excellence through quality. From....