Guide to Qualifying New Suppliers in Malaysia for Manufacturing Success

Malaysia is a premier manufacturing hub in Southeast Asia. According to the Malaysian Investment Development Authority (MIDA), “Malaysia, with its extensive trade....

By AMREP | Posted on July 26, 2025

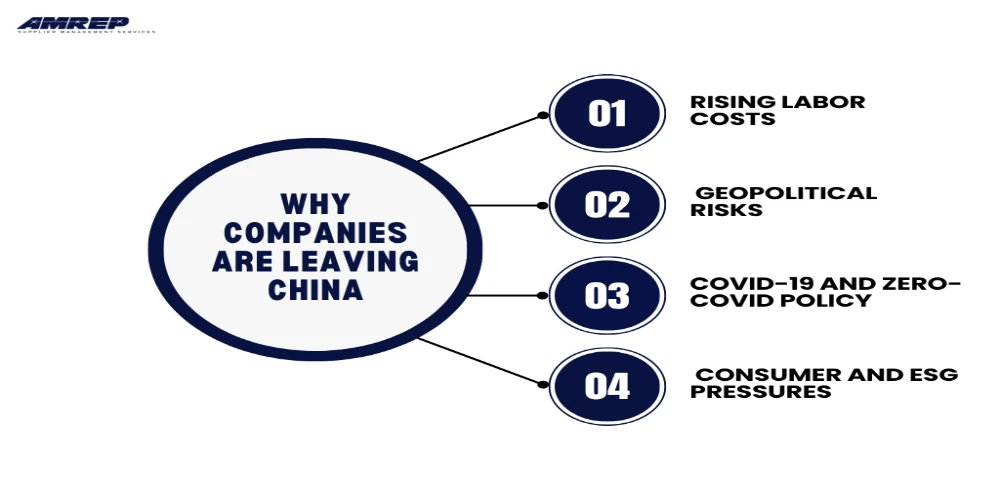

For the past two decades, China has been the backbone of global manufacturing, offering unmatched scale, speed, and cost efficiency. However, in today’s changing economic and geopolitical landscape, many businesses are rethinking their reliance on a single sourcing country.

Rising labor costs, supply chain disruptions, trade tensions, and growing demands for transparency have highlighted the risks of concentrated production. As a result, companies across sectors like electronics, textiles, and consumer goods are exploring new manufacturing hubs to build more resilient operations.

This guide will help you understand the key drivers behind the shift away from China, assess global alternatives, and plan a smooth, strategic transition for long-term success.

Before we delve into the key factors driving this shift, let's explore the broader context behind why companies are reassessing their reliance on China.

China's labor cost has increased substantially over the past decade. In 2010, the average manufacturing wage was around $2/hour; today it exceeds $6/hour in many coastal regions. These rising costs have reduced the profit margins of low-cost, labor-intensive industries.

U.S.-China trade tensions, tariffs, and sanctions have created uncertainty. Tech companies, in particular, have faced hurdles with export restrictions, supply bans, and licensing complications.

Pandemic lockdowns severely disrupted Chinese factories and logistics. Businesses learned the hard way about the risks of relying too heavily on one geographic region.

Consumers and regulators are increasingly focused on supply chain transparency, environmental standards, and human rights. Some Chinese regions have been flagged for labor rights concerns, pushing brands to look elsewhere.

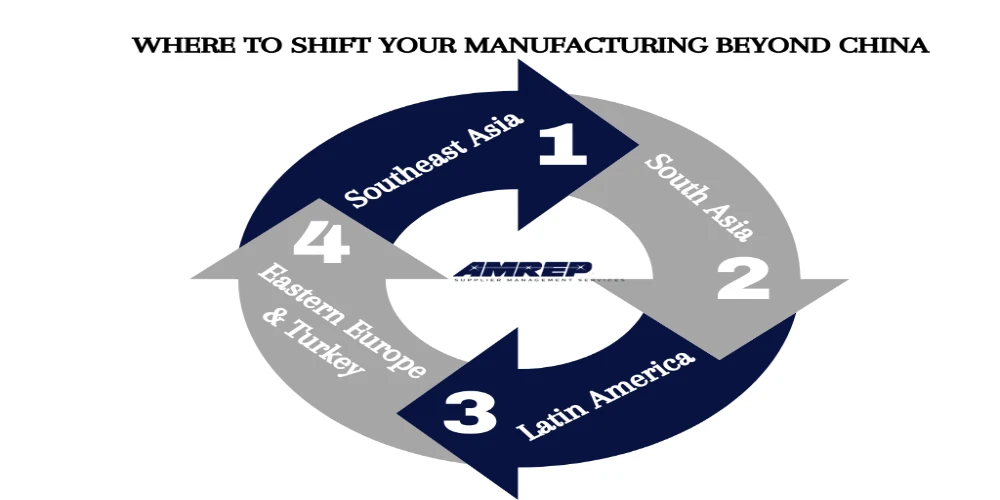

Shifting out of China does not mean finding a single replacement. Most companies adopt a “China +1” strategy by keeping some operations in China while diversifying into one or more additional countries.

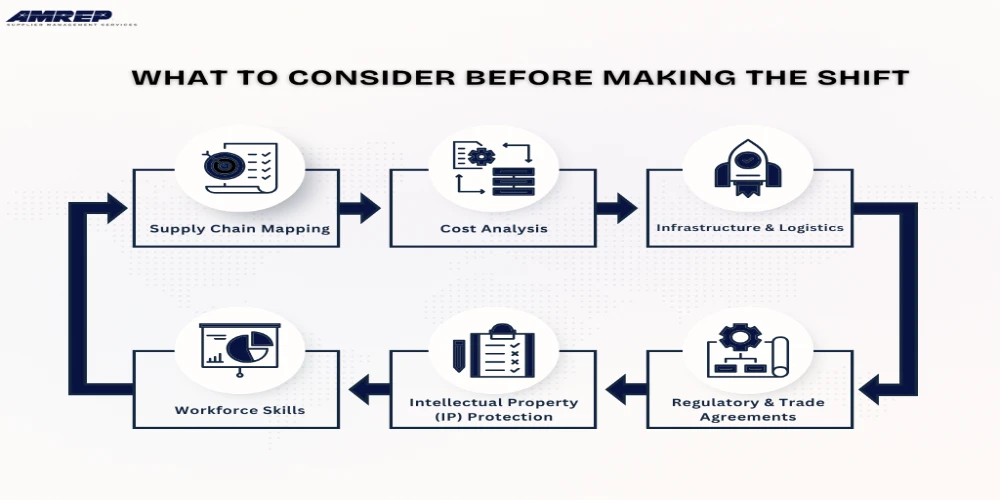

Shifting your supply chain is a long-term decision. Here’s what you need to consider:

Before anything, understand your current supply chain all the way from raw materials to finished goods. Know who your Tier 1, Tier 2, and Tier 3 suppliers are. Identify choke points and high risk dependencies.

Cost is more than labor. Consider:

Run a total landed cost (TLC) analysis to compare options.

Assess road, rail, port, and digital infrastructure. For example, while Bangladesh has low labor costs, port congestion can delay shipments. Vietnam’s infrastructure is improving but still lags behind China’s in many ways.

Look for countries with Free Trade Agreements (FTAs) with your target markets. For instance:

For tech and branded product manufacturers, IP protection is critical. Countries like India, Mexico, and EU members offer stronger IP laws than some others.

Labor-intensive industries might benefit from cheap labor, but skilled work (like electronics assembly or precision engineering) requires trained personnel. Investigate the availability and quality of vocational training institutions in your target country.

Shifting production away from China can be a strategic move, but it often comes with practical challenges that need to be carefully managed to avoid disruptions and unexpected costs.

Switching suppliers or factories can result in temporary downtime, leading to product shortages or delays.

Quality consistency is often the biggest challenge during relocation. New factories may take time to meet your brand’s standards.

China’s mature supply chain ecosystem includes not just assembly plants but component manufacturers, packaging units, logistics hubs, and testing facilities — all within close proximity. Most alternative regions don’t yet offer such seamless ecosystems.

Sudden changes in government, labor laws, or exchange rates can impact your cost structure. For instance, Sri Lanka faced currency depreciation and political instability that affected many global brands.

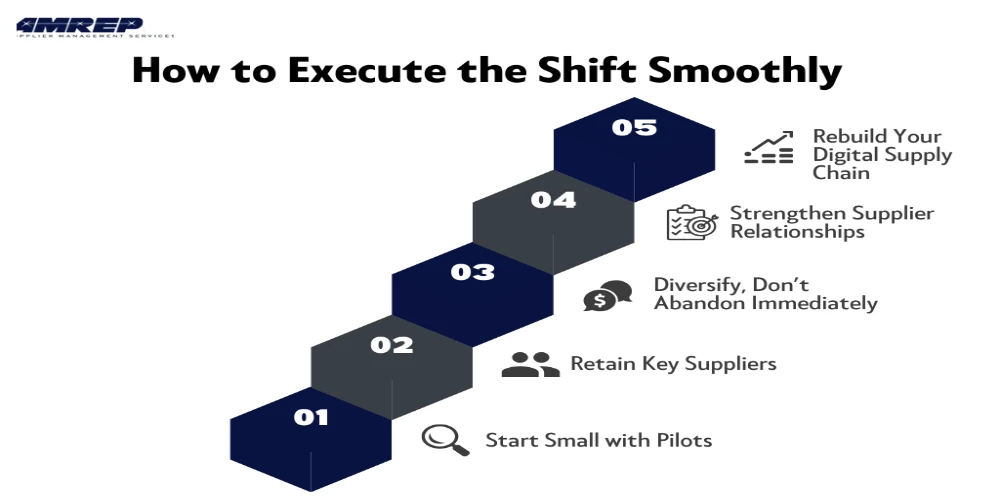

Successfully transitioning your supply chain requires a thoughtful, step-by-step approach that balances risk, cost, and long-term stability across new manufacturing locations.

Test the waters with a trial production run in a new region. Evaluate quality, lead times, and scalability before making a full switch.

If your Chinese supplier is highly reliable, ask if they have plants or partners in other countries. Many large suppliers are opening operations in Vietnam, Mexico, and India.

Gradual transition is often wiser. Keep mission-critical or high-volume items in China while shifting others to alternative regions.

When entering a new market, take time to build trust. Conduct on-site visits, co-develop quality control protocols, and invest in training and tech transfer where needed.

Use tools like ERP systems, real-time inventory trackers, and demand forecasting software to adapt to the new supply chain dynamics. Visibility is key in managing multi-country supply chains.

To better understand how supply chain diversification works in practice, let’s look at how some of the world’s leading brands are shifting their strategies and adapting to new manufacturing landscapes.

Apple began moving some iPhone production to India through partners like Foxconn and Pegatron. It also expanded its supply base in Vietnam for AirPods and other components.

Nike continues to shift more of its footwear manufacturing to Vietnam, Indonesia, and Cambodia, reducing its reliance on Chinese factories.

Samsung closed its last smartphone factory in China in 2019. It now relies on Vietnam and India for its mobile device production.

Lego invested over $1 billion in a new factory in Vietnam to serve growing demand in Asia without being solely dependent on China.

Before engaging new suppliers, it’s essential to assess their capabilities and compliance standards. Our guide on Supplier Audits: What They Are and Why Your Business Can’t Ignore Them breaks down how audits can protect your brand and ensure operational integrity.

As companies plan for long-term resilience and growth, several emerging trends are redefining global manufacturing, offering new opportunities, technologies, and strategies that will shape the next era of supply chain management.

Companies are increasingly favoring production closer to key markets. For example, U.S. brands are looking to Mexico and Latin America, while European firms consider Turkey or Eastern Europe.

As labor costs rise globally, businesses are investing in automation and robotics to improve efficiency and reduce dependency on manual labor.

Environmental, Social, and Governance (ESG) metrics are becoming vital in supply chain decisions. Consumers expect ethical sourcing, waste reduction, and carbon transparency.

The pandemic taught businesses that the cheapest option isn’t always the best. Supply chain strategies are now prioritizing resilience and agility over pure cost savings.

To ensure a smooth transition when shifting production, it's also important to understand the potential risks involved with outsourcing. Learn more in our guide on Common Problems with Contract Manufacturers and How to Solve Them.

At AMREP, we help businesses navigate complex sourcing transitions with clarity and confidence. From identifying the right manufacturing hubs to evaluating reliable suppliers and optimizing supply chain resilience, our local teams across Asia, Latin America, and other key regions bring deep market insight and strategic execution to every step of the process. Our comprehensive Supplier Monitoring Services ensure that quality, compliance, and performance are consistently maintained across your supply base.

As global supply chains continue to shift, choosing the right partner is more important than ever. With AMREP by your side, you gain a trusted advisor dedicated to making your transition from China smooth, strategic, and sustainable. Connect with us today to start building a smarter, more resilient supply chain for the future.

Contact Us To See What We Can Do

Call Us

Mon - Sat 9.00 - 18.00

Sunday Closed

12 - May 2025

12

May

2025

Malaysia is a premier manufacturing hub in Southeast Asia. According to the Malaysian Investment Development Authority (MIDA), “Malaysia, with its extensive trade....

22 - April 2025

22

April

2025

Healthcare is rapidly evolving, ensuring consistent and high-quality patient care. Total Quality Management (TQM) in healthcare is more than just a buzzword—it is a powerful....

16 - April 2025

16

April

2025

Total Quality Management (TQM) is a mindset that involves everyone in the organization working toward a common goal: achieving excellence through quality. From....